The Role of Financial Offshore Structures in Wealth Planning and Asset Succession

The Role of Financial Offshore Structures in Wealth Planning and Asset Succession

Blog Article

Understanding the Relevance of Financial Offshore Accounts for Business Development

In the dynamic globe of global business, financial offshore accounts stand as essential devices for service development, providing not only enhanced currency flexibility yet also prospective decreases in transaction expenses. This intricacy invites additional expedition right into exactly how organizations can effectively harness the advantages of offshore financial to drive their development initiatives.

Key Advantages of Offshore Financial Accounts for Organizations

While many services seek competitive advantages, the use of offshore monetary accounts can supply substantial advantages. In addition, overseas accounts often offer better interest prices contrasted to domestic financial institutions, boosting the possibility for earnings on still funds.

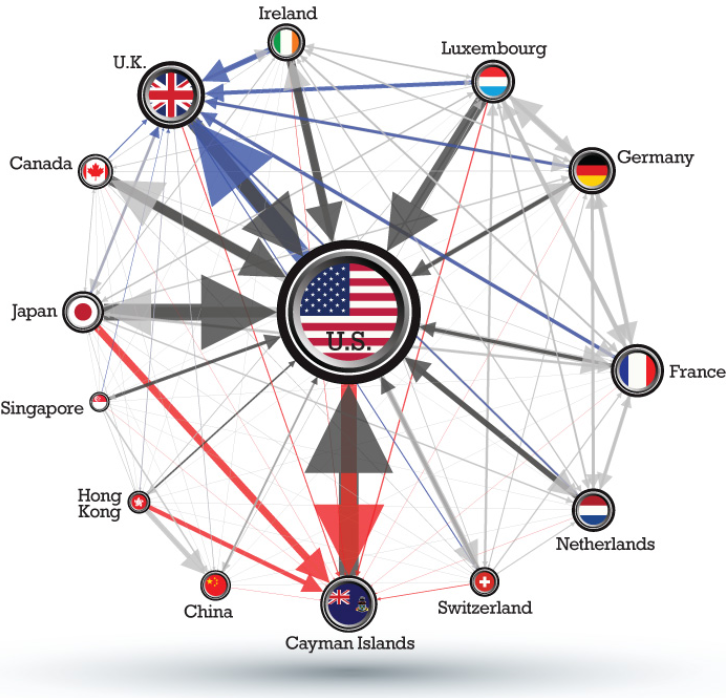

Moreover, geographical diversity fundamental in offshore banking can act as a danger management tool. The privacy given by some overseas jurisdictions is a critical element for businesses that focus on confidentiality, especially when dealing with delicate transactions or exploring brand-new ventures.

Legal Considerations and Compliance in Offshore Financial

Although offshore economic accounts provide countless advantages for companies, it is critical to recognize the legal structures and compliance needs that control their use. Each jurisdiction has its own collection of regulations and regulations that can considerably affect the effectiveness and validity of offshore banking tasks. financial offshore. Companies have to ensure they are not only abiding by the laws of the country in which the offshore account is situated yet also with worldwide financial regulations and the regulations of their home nation

Non-compliance can lead to extreme legal consequences, including charges and criminal costs. It is vital for businesses to engage with legal professionals our website who focus on worldwide money and tax obligation regulation to browse these complicated legal landscapes efficiently. This assistance assists ensure that their overseas banking activities are conducted lawfully and more ethically, straightening with both worldwide and nationwide requirements, thus guarding the firm's credibility and economic health and wellness.

Approaches for Integrating Offshore Accounts Into Service Procedures

Incorporating overseas accounts right into business operations requires mindful preparation and strategic execution. It is important to pick the appropriate territory, which not just lines up with the company objectives but likewise offers political and economic security.

Organizations need to integrate their overseas accounts into their general financial systems with transparency to keep trust amongst stakeholders (financial offshore). This involves setting up robust bookkeeping practices to report the flow and track of funds properly. Regular audits and evaluations find out here now need to be conducted to mitigate any dangers related to overseas banking, such as fraudulence or reputational damages. By methodically applying these methods, companies can successfully use overseas accounts to support their growth initiatives while adhering to lawful and ethical criteria.

Conclusion

In final thought, offshore financial accounts are vital properties for services intending to increase globally. Integrating them into company operations strategically can considerably boost money flow and straighten with broader service development goals.

In the dynamic world of global commerce, monetary overseas accounts stand as pivotal tools for service growth, using not only better money flexibility but additionally potential decreases in deal expenses.While many services seek competitive benefits, the use of overseas monetary accounts can provide considerable advantages.Although overseas financial accounts offer many advantages for businesses, it is essential to comprehend the lawful frameworks and conformity needs that regulate their usage. Organizations must ensure they are not only abiding with the regulations of the country in which the overseas account is located yet also with global economic laws and the regulations of their home nation.

Report this page